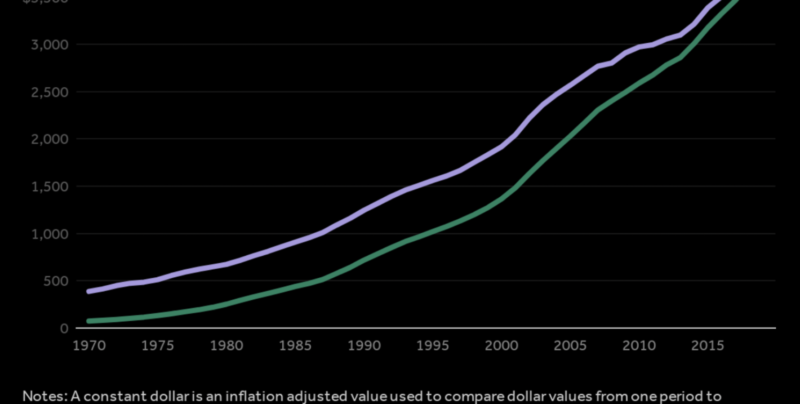

The Lone Star State needs a health care cost fix, and soon. Health care spending in Texas is rising by 6% per person every year, meaning it more than doubles every 12 years. At the current rate of growth, by 2030 it will cost an additional $174 billion just to keep the current number of Texans covered — that’s $60 billion more than the total annual budget of Texas’ state government. With premiums continuing to rise, only 29% of Texas’ small businesses can afford to offer insurance to their employees.

Texas is on an unsustainable trajectory toward sizable tax increases and benefit cuts. Either would lower living standards for millions and prove politically disastrous. But there’s a clear solution to the problem. We have to enable innovation and competition to put dollars back in the hands of consumers, businesses and our state budget. This will require courage from lawmakers to face down insurance companies and health care systems that don’t want competition and profit off the status quo.

The Legislature made a promising start last session by allowing the Texas Farm Bureau to offer affordable health coverage to its members and requiring hospitals to post the prices of their services, helping patients shop for the best-value care. But there’s much more to be done. The tiered penalties leveled by this price-disclosure law against noncompliant hospitals — up to $1,000 a day for the biggest providers — are still too low. A similar rule at the federal level is already being widely ignored.

Texas should double down on price transparency, extending it to all care providers, not just hospitals, and enforcing stiffer penalties for rule breakers. By creating incentives for shopping and containing costs, true transparency could save Texans as much as $7 billion annually on health care spending, according to preliminary research by Josh Archambault for the Cicero Institute, a nonpartisan think tank I chair. Based on the latest estimates, this could cut annual cost increases by as much as half.

Innovation can help pave the way to cheaper and more accessible care. In telehealth, companies like Ginger are driving a revolution in treating mental health through artificial intelligence-powered virtual therapy, and Texans deserve to be included in the benefits. There’s also a major opportunity for the direct care model, in which patients pay up front for regular services instead of going through insurance as a middleman. This model is already being used for primary care, but legalizing direct care for specialists, like Tennessee already has, can supercharge savings.

Finally, Texas could crack down on crony behaviors that unfortunately are common practice between many large players in the health care industry. Lawmakers should ban the monopolistic use of exclusive contracts, such as contracts in which hospitals essentially prevent insurance companies from contracting with other hospitals in the area. Such contracts only raise prices on consumers and businesses.

I’m proud to call myself a Texan, and have always admired the bold, independent and can-do attitude of our state. But Texas is at a crossroads, and debates over “who pays” and the issue of expanding Medicaid miss the crucial point. The status quo leads to a Texas in which an angry working class, unable to afford health care, will turn to extremist ideologies. I don’t want to see a neo-Marxist governor elected in 2030. But that’s where we’re heading if we don’t stand up to our crony health systems.

If lawmakers courageously embrace innovation and competition with these measures, we can drastically slow rising costs. We won’t just keep Texas free, we’ll become a model for the nation and lift up everyone — including the least well off in our society.

This piece originally appeared in the Austin American-Statesman.