“One must put themselves in the path of giants.”

– Lillian Cauldwell

Introduction

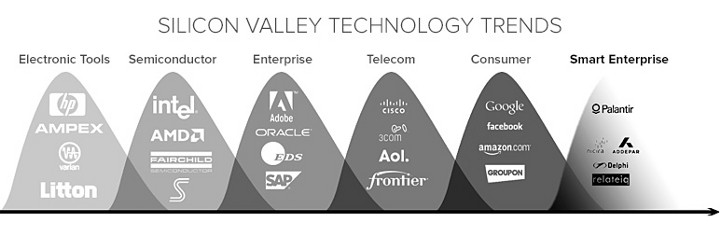

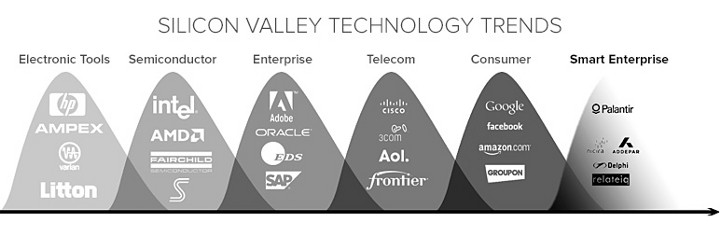

Over the last hundred years, five major trends have dominated Silicon Valley (SV): “Electronic Tools,” “Semiconductor,” “Enterprise,” “Telecom,” and “Consumer.” A sixth trend has emerged. We call it “Smart Enterprise.”

The Smart Enterprise wave will disrupt nearly every major sector of the global economy and dramatically improve productivity within those sectors, because it disrupts non-linear decision-making processes that are central to how major industries conduct business and create value. These decision-making processes have been complicated over the last two decades by the vast growth of digital information. In the past five years alone, the amount of data in existence has grown nine-fold, to over 2 trillion gigabytes. This increase has brought a corresponding increase in data complexity, formats, and silos that require sophisticated technology platforms to help knowledge workers process and leverage the information effectively.

Emerging Smart Enterprise platforms represent a significant investment opportunity. Companies can now measure, analyze, and aggregate large data sets to inform mission critical projects. Examples of digital data that were not previously accessible include energy consumption and production data from sensor networks; data on government expenditures and transactions; exposure and transaction data from institutional and private wealth portfolios; genomic IT data and information-related outcome analysis in healthcare; logistics and network distribution information; and personalized education data on student cohorts. At 8VC, our investment thesis involves identifying, building, and investing in the most value-creating platforms, especially in these industries with inherent winner-take-all dynamics.

Old Enterprise to Smart Enterprise

Companies like Oracle and SAP led the first enterprise wave by streamlining back-office processes to make corporations more efficient. Enterprise software helped push paper faster and speed up routine business tasks; think of “TPS reports” from the movie “Office Space”. Large, big-box software solutions streamlined the “assembly line” and brought basic automation to linear processes, such as payroll, accounting, supply chain and inventory management.

Although pioneering in its time, innovation in this space grew stagnant. Existing technology infrastructure is ill-equipped to address the novel information challenges that major industries face, making the process difficult and error-prone to append new features and add-ons. Clunky and dysfunctional user interfaces demand lengthy employee-training sessions and CTOs pay IT consultants large contracts just to create reports from the data. Implementation of the systems themselves can take months and sometimes years. The biggest companies devote much of their resources to sales and marketing efforts rather than serious innovation. Perhaps for these reasons, Y-Combinator once wrote: “If you don’t think you’re smart enough to start a startup doing something technically difficult, just write enterprise software.

In the Smart Enterprise space, companies are re-inventing and replacing the decades old technology infrastructure behind major industries. To accomplish this, engineers are solving hard technology problems involved in integrating disparate data into conceptual structures that knowledge workers can intuitively access and manipulate. Valuable, machine-generated data resides in diverse sources: databases, excel spreadsheets, and other unstructured forms on the internet. By unlocking the patterns in and usability of the data, knowledge workers will solve problems the creators of the software did not even foresee. For example, in the intelligence community, analysts can complete complex tasks — like tracking international moneylaundering schemes or re-building communities in war-torn areas — that require connections across networks informed by structured and unstructured data. The same goes for global bankers, multinational lawyers, retailers with distributed supply chains, medical researchers, and other professionals who face complex challenges.

Defining Smart Enterprise

1. Integrate heterogeneous big data and empower knowledge workers to solve non-linear problems.

2. Leverage recent IT advances — chiefly from the consumer wave — to solve critical challenges in major industries.

3. Potential to harness network effects within industry verticals and become platforms, increasing innovation by enabling novel applications to quickly spread throughout the industry.

PLATFORM TECHNOLOGY

Platforms typically begin as useful applications to solve single problems, such as electronic healthcare records, student information services, or energy consumption reduction. As the platforms gain access to increasing amounts of data, the owners of the platform may build additional applications and eventually an open infrastructure to allow third party developers to innovate as well. These vertical platforms can enable application developers to reach tens of thousands of users without having to re-create the application for each medical office, school system, or energy grid.

At present, for instance, if a developer builds a market-changing technology to improve operations at a municipal water facility, the facility owner can apply the product in that locale only. However, developing a standardized platform across water districts will exponentially increase the platform’s value, by simplifying complexity in huge networks of information. For another example, consider the mobile space, where extensive software and hardware ecosystems have grown around the Android and iOS platforms. An iOS developer can build one application and potentially reach over 400 million iOS devices.

This openness pushes new waves of innovation as go-to-market costs plummet for application developers. The owners of the platforms, in turn, capture winner-take-all dynamics. In major old-line industries, where incumbent players feed off of closed infrastructure, market shifts will be especially pronounced for those smart enterprise technology companies able to insert themselves into the technology infrastructure and integrate disparate data sets.

INDUSTRY TRANSFORMATION

The major enterprise industries, including government, energy, finance, healthcare, and business services, comprise 70% of industry value as a percent of GDP. Each of these industries suffers deep inefficiencies. To see some of these problems and the solutions underway, consider the following examples from companies in the 8VC portfolio and investment pipeline.

Government

Problem: State and local governments spend more than $30 billion on old enterprise software, built for the paper environment. Knowledge workers cannot derive insights, ask relevant questions, or manage information flow. Sometimes they cannot even tell how much money their entity spends. As a result, cities across America find themselves in financial crisis — in California alone, three cities filed for bankruptcy in 2012.

Solution: The platform being built by OpenGov allows governments to visualize critical financial data; analyze the data to flag waste; perform cross-city comparisons and benchmarks to find best practices and new efficiencies; and share financial transactions and budget colloborations to improve transparency and workflows.

Energy

Problem: Energy consumption in developed and emerging markets continues to rise while production becomes more challenging. As easily accessible sources are depleted, producers must target more technically complex fields to extract natural resources. For example, more than 50% of original U.S. oil reserves remain down hole leaving 100 billion barrels ($10 trillion) which are not economically recoverable today.

Solution: Equipping production wells with sensors and big data applications could drive 100% improvements in efficiency and extraction. Through novel sensor technology and software, NeoTek optimizes production and reservoir models to overcome the problem of leaving much of the oil within the reservoirs behind. Taxon Biosciences utilizes a proprietary bioinformatics approach to develop and identify microbial species that accelerate the conversion of unconventional energy sources (heavy oil, coal, shale oil.) to natural gas.

Financial Services

Problem: Private wealth management firms spend more than $10 billion to separately create and maintain their financial aggregation, reporting, and analysis infrastructure. Innovation is slow because no single platform exists. Millions of people receive PDFs from funds and manually enter data into their systems from a variety of schemas, causing confusion, enabling fraud, and inhibiting sophisticated analysis. itinfrastructure

Solution: Addepar is building an open platform to help investors access and understand their information. Addepar aggregates disparate sets of data, reconciles and augments that data, and provides best-in-class analysis and reporting for large private banks and registered investment advisors (RIA). For the first time, investors see all their data in real time, allowing them to perform lightning-fast analysis to address concerns while they are manageable and relevant. As an open platform, Addepar will foster an ecosystem of applications and fundamentally change how a large segment of the financial sector sells products and services. For example, a company selling tax deferral insurance products could write an application for the platform to empower an advisor to see exactly which of his clients could save money with its products and how it would work. Rather than being re-written and customized for every RIA or family office, an open platform allows the application to automatically and intelligently manage trillions of dollars of capital.

The IT infrastructure that runs major industries has been kludged together in pieces in vain attempts to keep up with the demands of big data analyses, and is ready to be replaced.

Healthcare

Problem: The healthcare industry remains largely paper-based, and current systems are ill-equipped to handle transformational innovations, such as electronic medical records, cheaper testing solutions, and full genetic sequencing for individuals.

Solution: Innovation from startups like Health Tap, Palantir, and Practice Fusion may save hundreds of billions of dollars, by bringing data and doctor interaction online and then enabling patients and doctors to make informed decisions. Leveraging these interactions and data with insurance companies and healthcare organizations will add massive value per patient and simultaneously lower costs.

Business Services

Problem: Although many functions, such as sales, recruiting, and business development, have transitioned into the cloud, data analysis still requires manual collection and input. Volume, accuracy, and timeliness of information are compromised in the process, which reduces the value of the information in these digital systems.

Solution: RelateIQ is transforming the CRM space by building a technology solution to collect data automatically from available sources to enable intelligent insights for sales, recruiting, investor management, and other critical business pipelines. With access to communication data within and between organizations, RelateIQ leverages advances in data science to create advanced, real-time collaboration tools to dramatically improve key business functions.

THE IMPORTANCE OF STARTUPS IN SMART ENTERPRISE

Startups will play an important role in the Smart Enterprise wave. This is not obvious to many outside of Silicon Valley. For most of the twentieth century, innovation came from large corporations, including places like Bell Labs, GE, Xerox PARC, and HP. Those companies invested large sums into innovation; because innovators had to build everything from the ground up, large corporations were among the few entities that could afford to outfit competitive technology teams. They also supported cultures that attracted brilliant people. But the financial cost to innovate has decreased in the last few decades, and it continues to fall. Today’s computers and software systems support rapid conceptual iteration orders of magnitude more powerful than those at the disposal of scientists at Bell Labs. In an inter-temporal hackathon competition, a couple of today’s top engineers would run circles around a team of top talent from 20 to 30 years ago, in any area and at a fraction of the cost.

Technology startups maintain other advantages. Incentives in a focused technology culture are better aligned, because the upside for a particular project is shared among the value-creators. Smaller teams can also maintain more nimble development cycles, flexible work environments, and an absence of politicking and bureaucracy. For these reasons, Smart Enterprise startups attract the top talent now. Palantir, for instance, is regularly cited as attracting the top engineers and other companies like Box, Addepar, and RelateIQ attract top engineers as well.

Given this powerful dynamic, many talented young technologists and entrepreneurs sense the startup opportunity and write off large corporations completely. This is misguided. The global marketplace is an evolving ecosystem, with startups and large corporations playing increasingly complementary roles. To address the world’s hard problems and drive progress, startups need corporations and corporations need startups.

Corporations have scale, existing relationships, and distribution advantages in large, established industries such as energy, education, healthcare, logistics, financial services, and government services. Corporations also possess latent knowledge and expertise by virtue of past work on major problems. They may know better than startups the next complex, valuable problems likely to emerge. Accordingly, and notwithstanding that they may have an advantage on the innovation side, many Smart Enterprise startups would do well to partner with large corporations that control the data, the knowledge workers, and the distribution channels. These partnerships will prove especially valuable in industries that require significant upfront capital investments.

Conclusion

Despite crises in governments and other important institutions, we believe that the Smart Enterprise wave will fundamentally disrupt key sectors of the economy and enable a prosperous 21st century. 8VC invests in new technology platforms that transform how critical industries tackle increasingly difficult challenges. These emerging platforms will re-invent the core intelligent infrastructure of major industries and create out-sized economic value for those who use the platforms, create them, and invest in them. As Smart Enterprise platforms become widely deployed over the coming decade, entrepreneurs will shift their effort toward developing applications on these vertical platforms. Platform-enabled application ecosystems will positively impact global productivity and growth.

At its core, innovation is about solving hard problems that matter to the industries that run our world. Startups will solve these problems. But they, and those that support them, will succeed by understanding the industries dominated by established players and, in many cases, by learning how to work well with industry leaders to solve hard problems and scale the solutions. For their part, large corporations must partner well and share the upside with innovative Smart Enterprise companies, or they will fall behind.

We have many reasons to remain hopeful and must work together to solve the world’s biggest problems. More people aspire to entrepreneurship today than at any point in the past century. Costs to innovate have plummeted. Engineers have the opportunity to build and focus their talent and energy on major global problems. Together, we will confront difficult technology challenges to help knowledge workers operate more efficiently within the largest industries. These tasks are worthy of our top entrepreneurial and engineering talent, and it is the role of the top technology funds to support and nourish these emerging ecosystems.

Joe Lonsdale

Partner, 8VC

Founder, Palantir and Addepar