“Though only the generals’ names may be remembered in the history of any great campaign, it has been in a great measure through the individual valour and heroism of the privates that victories have been won. And life, too, is ‘a soldiers battle’–men in the ranks having in all times been amongst the greatest of workers.”

– Samuel Smiles, Self Help, 1882

The Quiet SMB Revolution of the 2010s

There are 5.7 million businesses in the United States, 89.9% of which have fewer than twenty employees. In aggregate, small and medium businesses (SMBs) produce nearly half of GDP and account for roughly 60% of new job creation. They are the lifeblood of the American economy.

The coming decade will see substantial technology disruption in the SMB space. The rise of the mobile ecosystem has opened up a positive feedback loop that is making it easier to scale technology startups in SMB. The result will be a proliferation of smart technologies aimed at improving SMB workflows: everything from sales and marketing to HR and payroll processes will be revolutionized. While these kinds of technologies have been improving for larger companies over the past several decades, startups are increasingly developing software specifically for SMBs, which require lower implementation and maintenance costs and a shorter learning curve — almost a consumer/enterprise hybrid. As SMBs benefit from new data and technology, hundreds of billions of dollars of wealth will be created.

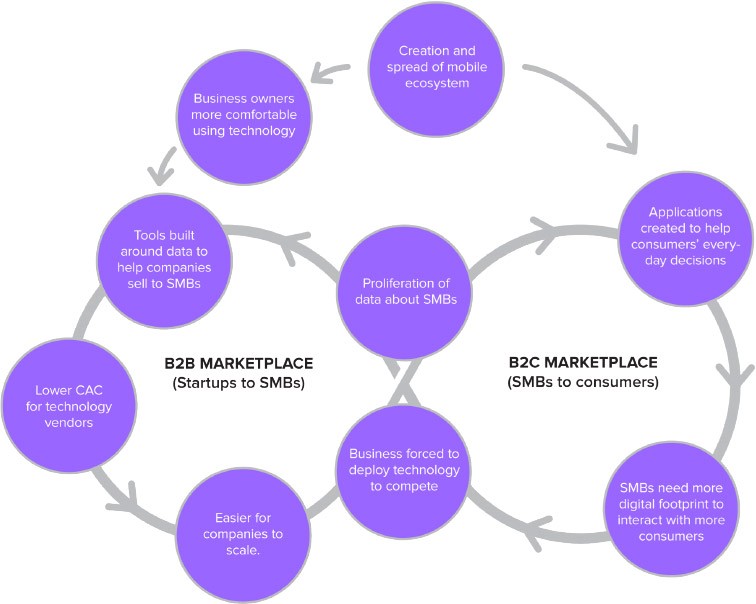

The positive feedback loop cycles between the B2B marketplace, where startups sell technology to SMBs, and the B2C marketplace, where SMBs sell products and services to customers. This loop drives up the quality and quantity of data available on SMBs, drives down the cost of customer acquisition (CAC), and ultimately creates more demand for new technologies while making it cheaper for them to expand. Never before have so many technology startups grown as quickly within the SMB space, and as the positive feedback loops iterate, the pace of growth will increase.

Historical Challenges Of The SMB Space

Selling to SMBs has always been a large part of the U.S. economy, but there have historically been challenges to attaining scale. First, distribution has been a major obstacle. Each business is only a small customer, and it is expensive to engage with each one on an individual level. In previous eras, companies have had to rely on old-line distribution channels, such as spots on the radio or newspaper ads. The CAC was generally too high for a company to be able to attain scale. Without targeted marketing, companies were left with but one strategy to “cross the chasm”: fire enough shots in enough directions to scale by brute force. More often than not, this disjointed strategy led companies to fall through, rather than cross, the chasm.

A few major disruptions in the SMB space did occur before the mobile revolution, but they mostly came from established companies who already had economies of scale. The Microsoft Windows and Microsoft Office platforms enabled players like Intuit’s Turbo Tax to spread to millions of businesses. Intuit’s software was such a vast improvement over previous workflows that it spread like wildfire. For most startups, however, this has been a difficult space to penetrate, and millions of SMBs still perform basic workflows like payroll or ordering by hand or Excel.

THE Mobile Revolution

The rise of the mobile ecosystem changed the game for startups selling to SMBs. This was not just a one-time disruption: the result has been an ongoing positive feedback loop that continues to make it easier for startups to improve how SMBs work. What is commonly thought of as the period of creative disruption that immediately followed the adoption of the smartphone was in fact just the start of this feedback loop.

The first iteration looked like this: with a computer constantly at their fingertips, SMB owners became more comfortable than ever before using technology. Many created a website, a social media presence, an eCommerce presence, or some combination thereof. Simultaneously, customers created a web of data about SMBs through tweets, likes, and shares, and reviews, etc. All of a sudden, there was an explosion in the quantity and quality of structured and unstructured data about SMBs.

In the B2B market, companies began developing tools to help startups leverage these new Internet channels. Facebook and Twitter, for instance, offered companies the ability to do targeted advertising. Other tools allowed companies to improve lead gen and do paid conversion and upsell.

Meanwhile, in the B2C marketplace, applications such as Yelp, OpenTable, and Groupon were developed to help consumers make everyday decisions. SMBs suddenly found themselves pressed to join these and other platforms in order to stay competitive. Competition caused SMBs to increase their digital footprint or risk losing revenue.

Pressures in both the B2B and B2C marketplace led SMBs to deploy a great deal more technology in the last decade than they ever have before, which has led to a greater proliferation of data about SMBs. This has further iterated the cycle.

The Current SMB IT Landscape

While the tools created in the wake of the mobile revolution represented a vast improvement over old-line marketing techniques, they still did not give technology vendors serious insight into their SMB leads. This is because they only had the ability to analyze structured data from a single source — Facebook advertising, for instance, used to only take into account what information businesses and consumers shared on the site.

Today, tools are being built to help technology vendors leverage both structured and unstructured data in ways that were never before possible. Formation 8 has a large stake in Radius, which is emerging as a leader in the SMB data space. Radius’ software plugs into its large corporate clients’ SMB databases and Salesforce accounts and aggregates the data to understand SMBs at scale. Radius is building an incredible data set that every SMB vendor wants to access. The result is a runaway network effect; Radius is becoming the ultimate advisor to companies distributing to these millions of businesses.

Radius and other associated tools in the B2B ecosystem are continuing to drive down the CAC for technology vendors. By providing keener targeted insights about SMBs, Radius is making it possible for startups to capture a foothold in the marketplace.

Datasets like Radius’ are driving down the cost of sales, but the cost to develop and deploy technology has also dropped precipitously. Access to cheap smartphones and tablets and the presence of existing technology frameworks has made it much less expensive to start and grow a company.

As the SMB technology ecosystem matures, we are seeing numerous quickly- growing platforms. Zenefits, for instance, allows SMBs to seamlessly integrate their health insurance, paid time off, and other HR systems into a single dashboard without having to change vendors, plans, or pricing. ZenPayroll, a Formation 8 investment, automates costly and time-consuming payroll processes for SMBs. Paychex and ADP have over 70 billion market capitalization, but their sales-driven models meant their CAC was too high to conquer the SMB long-tail. Over two million SMBs still spend hours each month running payroll by hand or in Excel, and are fined hundreds of millions of dollars a year in total because of mistakes in adhering to thousands of state and federal regulations. ZenPayroll leverages modern distribution channels and makes payroll a source of positive connection to employees and a positive HR tool; it is one of the fastest growing companies we’ve seen in the space.

ZenReach, another Formation 8 investment, uses a WiFi platform to give brick- and-mortar retailers better data about their customers’ activity, which allows them to do more targeted marketing and increase their in-store presence. Online retailers have access to an abundance of information about their customers that brick-and-mortar shops do not presently have: how many times someone visited the site, for instance, and how long they stayed. ZenReach can track customers’ activity at the store and then send them targeted emails based on their recent visits and purchases. What Google did for the click, ZenReach wants to do for the visit. Platforms like ZenPayroll and ZenReach are making it easier for SMBs to grow their businesses without having to worry about the hassle of the back office.

In addition to horizontal platform plays, we are beginning to see companies penetrate vertical SMB marketplaces. One of our investments, Buildzoom, is transforming the home improvement marketplace. Hundreds of thousands of consumers interact with tens of thousands of contractors each month, and Buildzoom makes it easy for customers to find the contractor that best suits their specifications. Another Formation 8 investment, Realscout, is disrupting the real estate space by providing agents with a customizable, branded search site. This allows them to maintain high-touch relationships with their clients. Other examples abound. The emergence of vertical SMB SaaS is evidence that the market is now ready for the spread of smart technologies into disperse corners of the SMB landscape.

As more and more companies scale into the SMB space, there will be an additional erosion of old-line distribution channels. SMB owners have often taken advice on vendors from local service providers such as their local banker, their insurance broker, etc. But emerging technologies are slowly eroding the amount of interaction SMB owners have with these middlemen. Technologists are revolutionizing the banking and lending industry, reducing the need for SMB owners to ever step foot in a bank branch. HR automation platforms are eating away at the need for brokers. Because of these changes, SMB owners will naturally turn to less costly distribution channels, and as their business is increasingly digitalized, it further opens them up to technology-enabled processes and products.

SMBs aren’t just turning to new distribution channels to discover vendors — they’re also turning to consumer-facing channels to increase their digital presence. New applications are being created to help consumers make everyday decisions: everything from StyleSeat to Buildzoom is helping to drive consumer behavior. SMBs are continuing to proliferate data about themselves, which technology vendors are using to market and sell to them in new and interesting ways. The feedback loops are continuing to iterate, which is propelling new technologies into the diffuse nooks and crannies of the SMB landscape.

This is an exciting time to be investing into this space because there are multiple greenfield situations where platforms clearly should exist but don’t yet. Unlike eras past, technologists can easily reach millions of small businesses, and these businesses are simultaneously realizing that paper- and Excel-based workflows are leaving them in the dust. Venture capital thrives on economic shifts like this. Several multibillion-dollar businesses are being built already and are scaling quickly into these newly open areas in SMB.

America needs its small and medium businesses to thrive if our economy is to thrive. Until now, market conditions kept most technologists focused on streamlining workflows and reducing costs in the enterprise while ignoring the problems facing the SMB. But economizing America’s small and medium businesses and helping them leverage data to better engage with their employees and customers raises our nation’s productivity and creates more wealth and prosperity for all of us. We are proud to be backing great entrepreneurs who are leading the charge to bring SMBs into the 21st century technology ecosystem. Thank you for joining us in this quiet but important revolution.

Joe Lonsdale

Partner, 8VC

Reid Spitz

Investor, 8VC