We recently put together a speech outlining the major functions of a modern Venture Capitalist. These notes from the speech articulate our basic framework for thinking about the shifting nature of the Venture Capital industry.

The Venture Capital industry currently manages about 100x what it did 30 years ago. As our industry has grown, it has evolved. The role of a modern VC has become substantially more nuanced and multifaceted than VCs of the 1970s and 1980s could have ever predicted. Today, many top Venture Capitalists are people who have started companies themselves. Venture Capitalists play a positive sum role in helping investors create value by partnering with entrepreneurs and give them every advantage possible to beat the odds and succeed. For many of us as VCs, it’s exciting to help instantiate new ideas for platforms and processes which improve how people live or how industries function. We’re eager to leverage our own experiences and networks to help entrepreneurs however we can, and continue to learn as we work on new projects.

The roles of the modern VC can be summarized as finance, community, and leadership.

As a financier, a Venture Capitalist might be:

(1) A Middleman. Wasteful Middlemen are what we like to call “New York Fabulous!” A sophisticated middleman will raise and allocate capital in a way that benefits society as a whole, rather than focusing on short term profits .

(2) An Expert at Structuring and Closing Deals. A VC must ensure that deals involve fair terms with no trickery as well as assigning the correct valuation to a prospective company. Deals must align the interests of parties involved so that they are mutually protected. This also applies to how a VC structures its fund vehicles.

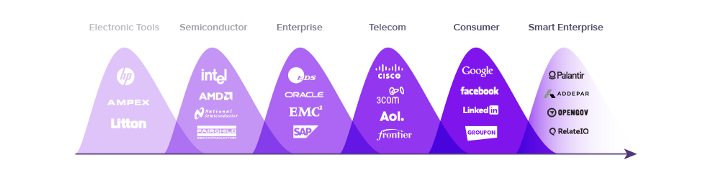

(3) Macro Analysis Investor. This is the more interesting part of finance! VCs must understand historic technology waves as well as predict emerging waves. We think that bioinformatics, smart enterprise, and transportation are three of the most important emerging technology waves as we head into 2017.

As a community builder, a Venture Capitalist might be:

(4) A savvy Network Connector for sales, customer feedback, and business development. A great VC network includes Sales, Customer Service, Business Development, and Channel Partners.

(5) A Talent Resource for hiring. VCs help portfolio companies hire top talent, and need to be able to help companies attract the right engineers, designers, sales superstars, executives, and board members.

(6) A Brand Creator for company and firm. Good brand creation is about building a trusted, respected community around your portfolio companies, which includes customer relevant networks, advisors, talent, internal operations, and your general brand. The involvement of a top VC is an important symbol for everyone around a startup — other investors, employees, potential partners and clientele. Today, the most impactful brands inside the technology world are created more with substance and success than through media. And clearly, this skill is related to a VC’s ability to build a relevant community achieve numbers four and five above for the company, as well.

As a leader, a VC might be:

(7) A Technology Consultant. In addition to providing financial support, today’s VC needs to be able to counsel portfolio companies on elements of data science, tech architecture, and design thinking. Some VCs should be fonts of advice on product or technology. Scaling a technology presents some of the hardest technical challenges for a growing company.

(8) Leadership, Management, and Strategy Mentor. Venture Capitalists serve an advisory role to budding CEOs. Top entrepreneurs are great engineers, but often not yet great leaders. Good VCs will teach entrepreneurs how to delegate authority efficiently and effectively, as well as how to scale a company. VCs who have been entrepreneurs themselves will be able to draw on their experiences to give budding CEOs specific, immediate feedback — creating value for all parties involved.

In the speech we put together — where each of these categories is a series of slides — we emphasize that not every VC plays all of these roles. Some specialize in certain areas, or have uniquely talented partners that complement each other well. But the bar has been raised and continues to climb, as investors with relevant experience and skills help startups across the board partner with leading entrepreneurs and create value. It’s amazing how this system has evolved and improved upon itself over the past decades through human ingenuity and market forces, and we are very bullish on many aspects of the top of the Silicon Valley ecosystem.